Poor tax communication from Digitalocean

Tax related issues are never too easy, so in communicating changes to your billing related tax procedures should be explained very clearly.

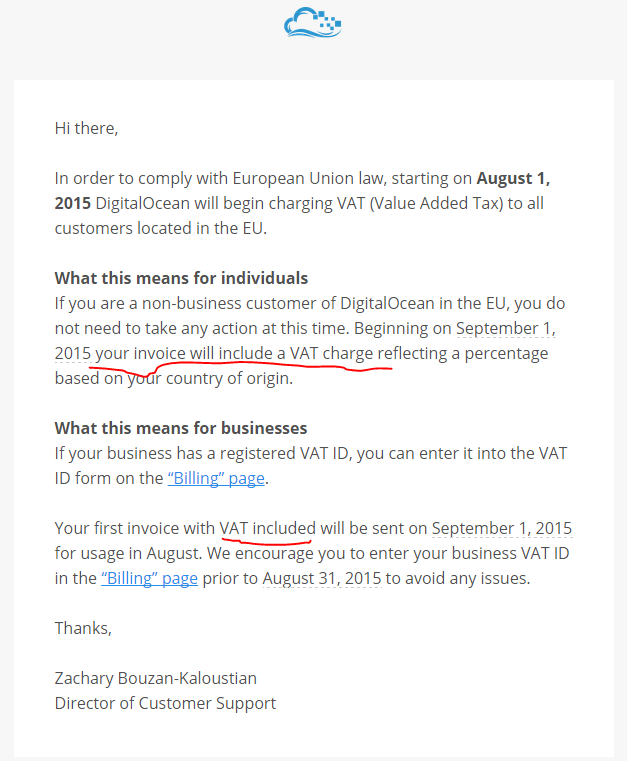

I received this email from Digitalocean:

It somewhat clearly states, that for individuals the price will be increased (“will include a VAT charge”).

How about for businesses? Will my price be increased? The words seem like yes (“your first invoice with VAT included will be sent” [on your next bill]).

But only when looking at the website, entering the VAT number states: “If you’re a registered business, enter your VAT identification number to remove sales tax from your monthly bill.”

Now they’re talking about “sales tax”. Is it the same as VAT? According to this article they are not the same thing.

So by entering my VAT number the “sales tax” will be removed (of which there was no mention in the email), but VAT will be included? How does this differ from “what does this mean for individuals” where they said that VAT charge will be included? Or in business case by “sales tax” are they referring to removing the VAT? Why do they say “with VAT included” (for businesses) in the email then?

This is a goddamn mess, and I can’t be bothered to contact them. Will just have to wait for the next invoice to see how it actually went.

In my opinion Digitalocean failed miserably here in communicating the effects of this change for businesses, in already difficult enough subject.